Step 1: Go to www.orientalfx.com

Step 2: Sign up

Step 3: Fill your informations

Step 4: Check your email

Step 5: Sign in ⇒ Congratulation! You are our customer!

1. Proof of Identification – current (not expired) coloured scanned copy (in PDF or JPG format) of your passport. If no valid passport is available, please upload a similar identification document bearing your photo such as National ID card. All informations must be in Latin character.

2. Proof of Address – a confirmation of current account. Please ensure however, that documents provided are not older than 3 months and that your name and physical address is clearly displayed.

3. A Bank Statement or Utility Bill. Please ensure however, that documents provided are not older than 3 months and that your name and physical address is clearly displayed.

* Important Note: The name on the Proof of Identification document must match the name on the Proof of Address document.

E-wallet is your wallet which keep all your amount on OrientalFX. It will show you exact the amount of crypto currency you have and USD.

1/ Show total valuation of your blance in USD.

2/ The exact number of currency you have.

Step 1: Login to my.orientalfx.com

Step 2: Choose Funds on Dashboard

Step 3: Choose Deposit

Step 4: Select the currency you want to do deposit

Step 5: Type your amount and check again carefully

Step 6: When you choose Proceed, the wallet address will appear

Step 7: Make Deposit into the wallet address ⇒ Complete.

*** MT4 platform on OrientalFX only accept USD. So that if you already have USD in your E-wallet then please check “FINANCE – question 20” to know how to transfer USD into your MT4 accounts. If you have USDT or OFX please check “FINANCE – question 32” to know how to make exchange to USD.

Step 1: Login to my.orientalfx.com

Step 2: Choose Funds on Dashboard

Step 3: Choose Withdraw

Step 4: Select your withdrawal method

Step 5: Type the amount you want to withdraw

Step 6: Add your own wallet (Note, if required)

Step 7: Click on Proceed ⇒ Completed.

– From 04:00 AM on Monday to 04:00 AM on Saturday.

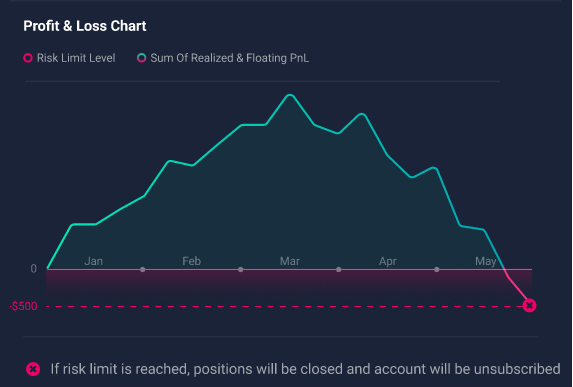

– Percentage allocation management module, also known as percentage allocation money management or PAMM, is a form of pooled money forex trading. An investor gets to allocate their money in desired proportion to the qualified trader(s)/money manager(s) of their choice. These traders/managers may manage multiple forex trading accounts using their own capital and such pooled moneys, with an aim to generate profits.

– It is worth to mention that all investors balances are copied to master (money manager) accounts, which has an aggregated balance of all connected accounts.

– MAM (Multi Account Manager) is designed for money managers. It is essentially an integrated software tool that can quickly execute block orders with just one click under a master account arrangement).

– With the MetaTrader 4 MAM account, money managers can quickly, easily and simultaneously place orders across multiple client accounts while remaining focused on the things that matter the most – trading strategy and money risk management.

– Social trading is the best account type for launching a retail investment product in brokerage company.

– At the same time, they can also trade on these accounts or close the positions opened by signal providers without any limitations.

– Investor can make the position opposite to Master’s position.

-

- Example: Master: BUY

→ Investor: SELL

– OrientalFX does not provide services to residents of the USA, Canada, Sudan, Syria, North Korea.

– OrientalFX have function:

-

- Foreign exchange dealing

- Issuing or redeeming money orders

- Money transferring

- Dealing in virtual currencies

– See here.